Price Transparency in Health Care:

Myths vs. Facts

+ MYTH 1: Patients seeing prices won’t lower prices – it might even cause patients to choose the highest priced service thinking that it’s the best.

FACT: All the published data show the opposite. Transparency almost always leads to savings. The amount of savings are directly associated with the presence and extent of incentives that are given to patients to use the information. When employers or plans offer zero/low cost-sharing for high-value care, or share savings with patients, uptake in usage of the tools increases significantly.

New Hampshire launched a simple crude public price transparency tool in 2007 (displaying just average prices), and on one category of services alone (imaging), patients saved almost $8 million and other payers (employers and taxpayers) saved $36 million over a five-year period. By year 5, out-of-pocket costs for consumers had dropped by 11%, and for people with deductibles, they saw almost double that in savings. Those are good results among the general public.

The state then took it a step further for its own state employees by creating an incentive program that provided financial rewards to employees who used the transparency tool to choose higher-value care. Within three years, the program has saved $12 million and paid out $1 million to employees. 90% of enrollees have used the tool, and 2/3 of them repeat shop and save each year, saving on average over $600 each time they use the program. In 2015 alone, the program produced a 13:1 return on investment. Kentucky started paying state employees shared savings incentives to use a price-shopping tool in 2013 and the state’s taxpayers saved more than $13 million, and the enrollees themselves received almost $2 million in incentive payments.

Some studies found that price transparency reduces prices by 10-17% , up to 14% . Other results are more modest when financial incentives are not provided to patients to shop, but they are never zero. With healthcare consuming a fifth of the economy, even the most modest results could make a huge difference. Employers who use “steering,” that is, incentivizing enrollees through zero cost sharing for using the lower-cost, high-quality providers, save on average double digits in the first year, and up to 60% several years in.

+ MYTH 2: Patients don’t need prices because healthcare is different – patients don’t really shop when they need care, since it is a third-party system.

FACT: Every time tools are made available to patients that align price transparency with incentives for choosing higher value care, patients do in fact shop and they choose higher value care, often saving millions for themselves and their employer.

Patients shopped in New Hampshire! New Hampshire launched a simple public price transparency tool in 2007 (displaying just average prices), and on one category of services alone (imaging), patients saved almost $8 million and other payers (employers and taxpayers) saved $36 million over a five-year period. By year 5, out-of-pocket costs for consumers had dropped by 11%, and for people with deductibles, they saw almost double that in savings. Those are good results among the general public.

But the state took it a step further for its own state employees by creating an incentive program that provided financial rewards to employees who used the transparency tool to choose higher-value care. Within three years, the program has saved $12 million and paid out $1 million to employees. 90% of enrollees have used the tool, and 2/3 of them repeat shop and save each year, saving on average over $600 each time they use the program. In 2015 alone, the program produced a 13:1 return on investment.

Patients shopped in Kentucky! As described above, Kentucky started paying state employees shared savings incentives to use a price-shopping tool in 2013 and the state’s taxpayers saved more than $13 million, and the enrollees themselves received almost $2 million in incentive payments.

Patients shopped in California! The retiree health program for California public employees (CalPERS) started using price transparency to develop reference prices in their benefit design. Providers quickly responded by lowering prices to compete for enrollees. The system saw a 9-14 point increase in enrollees using the more competitively-priced providers , and an overall reduction in prices by 17-21%.

Each of these examples, and dozens more from both public sector and private employer experiences with transparency initiatives within an insurance plan, proves that the third-party system does not have to be a barrier to consumerism. When purchasers of care have incentives, through benefit design and cost-sharing structure that reward higher-value care, enough people respond to those incentives to deliver meaningful price reductions.

This trend will expand, particularly led by millennials, the largest generational cohort in the U.S., 51% of whom surveyed by United Healthcare shopped for care online.

+ MYTH 3: Patients only need to see their own out-of-pocket costs, not the full contracted rate for all payers made public.

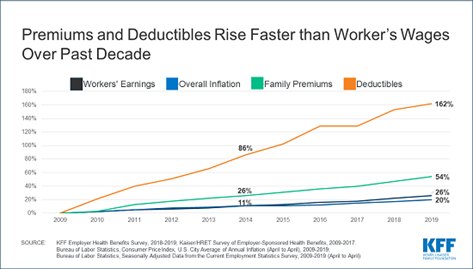

FACT: First, patients are bearing the entire cost of care out-of-pocket, due to the increase in deductibles over time. On exchange plans, deductibles can be as high as $10,000. Employer-sponsored deductibles have tripled in the past 10 years.

Second, employee share of premiums is very often the highest or second-highest out-of-pocket cost for patients. also out-of-pocket costs, and high priced care is what has driven and is continuing to drive premiums for Americans through the roof.

At the time of service, depending on the patient’s deductible status, an over-priced claim may not be entirely paid by the patient, but if not, it’s paid by the self-insured employer or the issuer for fully-insured plans. That cost history is what’s used to determine premium rates the next year. So high prices on the total health service, regardless of the patient’s immediate out-of-pocket share of that price, affects that patient’s out-of-pocket exposure through premium hikes the following year.

We see this phenomenon with painful clarity in the fact that exchange premiums doubled in the first five years of ACA implementation, such that almost everyone who isn’t eligible for federal subsidies has fled this unaffordable marketplace. Employer-sponsored plans are also unaffordable - premiums have increased 55% in the past decade. The number one driver of premium hikes each year are increasing prices – hospital prices increased 42% between 2007-2014 , and drug prices have increased more than the rate of inflation for each of the last 10 years. It’s these increasing prices driving up the premiums, not alternative explanations such as increased utilization (which has stayed largely flat or decreased ) or underlying costs of care (refuted by the fact that self-paying cash prices for most services have stayed relatively stable ).

+ MYTH 4: Public transparency across plans isn’t necessary, as long as patients have access to prices within their own plans.

FACT: Without the ability to compare the prices offered under their own plan versus other plans, patients and their employers have no way to know whether their plan is giving them the best deal. What’s more, there are a number of situations where the cash price of certain healthcare services is less expensive than the patient’s share of the insurance-contracted rate.

+ MYTH 5: Healthcare prices are trade secrets, proprietary between providers and insurers.

FACT: In every other business, the final price that a consumer pays for each item or service, or a bundled package of them, is not considered a trade secret – our economy would collapse if this maxim were applied to other services and products. Insurers and providers often argue that their contracted rates are proprietary information. But they provide that information to every patient, millions of times a day, after the patient is already on the hook financially, in the form of an Explanation of Benefits. Patients are under no obligation to protect that information, indeed, it’s considered by HIPAA to be part of their own health information to which they have an absolute right. They certainly could post it on Facebook or publish it on a web site with legal impunity if they so chose. Policies promoting price transparency merely demand that patients have access to this exact same information before they’re on the hook for it.

+ MYTH 6: If patients see prices, they’ll be afraid to get care they really need.

FACT: Patients shouldn’t have to choose between avoiding financial ruin and healthcare. But the solution is not to trick patients into getting care they can’t afford by hiding upfront prices. A key reason why prices are so financially ruinous in the first place is precisely because they can be – because of this deceptive, after-the-fact surprise attack billing strategy.

What’s more, patients who experience a ruinous bill after the fact for a routine procedure might just learn that they should avoid care, even when that care is not routine but lifesaving. Further, this argument conveniently protects providers, sworn to do no harm, from having to admit the financial harm they’re inflicting on patients and competing openly and honestly for their business on the basis of price and quality. Practice standards require providers to tell patients up front about the clinical risks of procedures they’re about to undergo, sometimes even requiring that patients signing off in writing that they have been so advised.

Why should the financial risks of the procedures be exempted from this disclosure? Providers worried about the good of their patients should make sure that their prices are fair and affordable in the first place rather than ambushing patients with catastrophic costs after it’s too late or a patient to object, negotiate or shop elsewhere.

+ MYTH 7: Price discovery will lead to higher prices because not every provider can afford to give their lowest price to all payers, and so they’ll raise prices for some payers (usually the ones with the most volume, that is, the most patients).

FACT: Americans understand volume discounts, and if the bigger “discounts” off the bloated sticker prices received by some insurance companies are due to high volume, providers should have nothing to fear from openly disclosing that fact. On the other hand, certain insurance companies are getting price “concessions” from providers due to less justifiable reasons, such as anti-competitive gag clauses, anti-steering clauses, best-price guarantees, and other reasons that run counter to the interests of patients, their employers, and other purchasers of care. The ability to see prices exposes that the “discount” is really just an anti-competitive pay-off for steering patients to those high-priced provider systems rather than lower-cost alternatives.

Independent of anti-competitive practices, it is true that a law of economics is that price competition will lead to convergence around a competitive price for services of similar quality. In other words, the staggering and irrational variability in prices for healthcare that leads to massive gouging of patients and other payers, will end. Sellers of care will then start to compete not only on price, but also on quality, convenience and other factors to differentiate themselves in the marketplace - just like in every other business.

+ MYTH 8: Consumers seeing prices will lead to an increase in prices, because providers have been offering lower prices out of fear that their competitors were undercutting them. Once they see that their competitors charge more than they do, they’ll raise their prices to match.

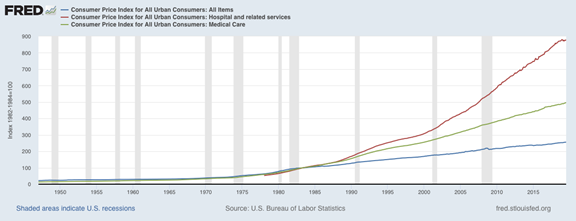

FACT: If this were true, we would expect to see a race to the bottom in healthcare prices, as hospitals and insurance companies scramble to undercut each other, not knowing if the other guy down the street is offering a lower price. Instead, growth in prices for healthcare has outpaced inflation every year in recent memory, especially for hospitals. See graphs below comparing the annual price increases for all goods/services compared to medical care, including hospitals, and another graph showing how insurance prices (as shown in premiums and deductibles over time) behave similarly.

+ MYTH 9: If prices become public, providers will engage in anti-competitive collusion to fix prices at a higher rate than they’re offering now.

FACT: Sure, some providers, upon seeing the prices of their competitors, could call up those competitors and plot to all offer the same price. Of course, that would be illegal collusion under our current anti-trust law. This argument is like saying that glass storefronts facilitate looting by tempting looters with a better view of what they might steal. The solution is to enforce laws against stealing and looting, not paint every window black. Under this logic, we should end the public display of prices at grocery stores, movie theaters, real estate listings and every other industry, because it might just facilitate illegal price-fixing among the sellers of these products. By the way, healthcare providers and health insurers, are incredibly sophisticated market actors. They already know what their competitors charge.

+ MYTH 10: Healthcare prices are too complex and confusing for patients to understand and respond to rationally.

FACT: Americans engage in complex commerce all the time, including comparing and choosing cell phone plans, trading stocks, buying and selling houses, comparing cable TV bundles to streaming options, selecting car insurance and then figuring out when and when not to use their insurance for repairs, and more. While all Americans might not use transparent price information, enough of them will. What’s more, employers and others who have influence over patients’ healthcare decisions will be able to use the information to design benefits, including cost-sharing, reference pricing, and formularies around that information. In this way, they could help patients make high-value decisions without having to independently analyze all the information themselves.

An example would be a self-insured union retiree health plan that uses a tool to analyze the prices of imaging centers. Some are contracted with the union plan, some aren’t. But even the out-of-network centers would have price variation around them. The union plan could then offer zero cost-sharing for lower cost MRIs at freestanding imaging centers, compared to a $100 copay for the pricey hospital-based center, regardless of network status. Patients wouldn’t have to analyze the prices of each center, they would just respond to the simpler decision between copay or no copay.

By the way, this strategy would mean that network status wouldn’t matter nearly as much, just the price and quality of the provider. Over time, the union would rely on the insurance company’s network negotiations less and less, and instead steer patients on the basis of transparent price and quality rather than network status of providers. This would increase the union’s ability to cut the middleman insurance plan out altogether and save enrollees even more.

+ MYTH 11: Most healthcare is essential and emergency. Patients can’t shop when they’re in pain or unconscious.

FACT: The vast majority of healthcare services are routine or elective (meaning, they’re scheduled in advance and not emergencies). Fewer than half of all hospitalizations originate from an ER visit. More than 70% of emergency room visits could be treated in a different setting, such as an urgent care or outpatient clinic. ER spending accounts for only 6% of all healthcare spending. Given these numbers, it would seem that most care is not the sort where a patient is utterly incapable of making judgments about where to receive care. Given how few ER visits are actual emergencies, it’s even likely that many patients who visit the ER are aware that their condition isn’t a life-threatening emergency, and are choosing the ER for other reasons, such as cost (you don’t have to pay before being treated), or convenience (24-7 access).

When health plans or their plan sponsors design benefits to give patients an incentive to use non-ER settings when appropriate, such as round-the-clock, zero-cost nurse lines or telemedicine, low-cost urgent care, walk-in or same-day primary care appointments, nurse midwives or chronic disease health coaches, ER visits have been shown to decrease and health outcomes improve. Even in cases of urgent conditions that do require an ER visit, most patients are conscious and able to make choices about which ER they prefer. In cities where there is more than one option and the situation is emergent but not life-threatening, such as broken bones or unmanaged pain in cancer patients, there is evidence that patients often choose to visit the hospital where their specialists have privileges or which are closer to their home, even if that is not the closest ER from where they’re starting.

+ MYTH 12: Most patients just go where their doctor refers them.

FACT: Patients currently have very little other information with which to make judgments other than a doctor’s referral. Before Yelp, Amazon reviews, Consumer Reports or Kelley Bluebook, customers for many other types of goods and services also only relied on word-of-mouth from trusted friends and authorities, such as their mechanic (for car purchases) or a chef friend (for restaurant recommendations). With the introduction of online shopping to obtain price information and crowd-sourcing tools such as Yelp and Kelley Bluebook to compile quality information, consumers are less likely to just take one friend’s word for it. This is especially true for homogenous services such as lab tests. Relying solely on word-of-mouth persists only in markets where reliable price and quality information is not otherwise available.

It is true that, even as other tools become available, a doctor’s referral is still one of the most powerful steering tools for patients, because of the trust relationship between doctor and patient. That is why, when price and quality information is baked into the referral work-flow, doctor referrals are one of the best ways to help patients find their way to high-value care. Innovative employers have found ways to harness the steering power of physicians by using on-site or near-site clinics, direct contracts and Centers of Excellence for specialist and complex care, with payment structures for providers that align physician referrals with the patient and employer goals of lower cost and high quality care. These models have shown double digit savings, with equal or usually better health outcomes.

+ MYTH 13: Showing all prices for all payers is a massive regulatory burden on hospitals.

FACT: Each year hospitals and health systems, physician groups, and other health care providers engage in mergers and acquisitions – over 100 deals each year, on average. Almost all of these transactions result in the exchange and analysis of proprietary rate information prior to consummation.

In the context of a merger or acquisition, rate information is generally disclosed in a time efficient manner. While it may take additional effort from finance executives, it is neither impossible nor prohibitive to produce. Further, the ability of third-party firms to quickly assess the disclosed negotiated rate information and create go-forward financial models is well established.

+ MYTH 14: Hospitals cannot give prices in advance since they don’t know which services a patient will need prior to care.

FACT: Saying that hospitals can’t tell patients prices upfront because they don’t know the specific combination of services a patient might receive is tantamount to a restaurant refusing to show customers a menu because they don’t yet know what the customer will order or what coupons they’ll bring with them.

Customers face this type of business transaction all the time in other industries and it creates no impediment in those industries to providing upfront price lists, even in the face of uncertainty about the exact combination of services that will be provided. Industries like this include law, body shops (who also have separate prices for different insurance companies), consultants, graphic designers, plumbers, general contractors, and others who combine hourly labor rates with add-ons for certain projects and parts/equipment. Healthcare is not unique in this way and its practitioners deserve no special exemption from disclosing to consumers their prices.

+ MYTH 15: Rural hospitals will have to shut their doors, because they won’t be able to offer competitive prices in a transparent world.

FACT: From a fairness standpoint, patients receiving care in a rural hospital are just as deserving as all other patients to know how much services costs ahead of time, especially if they are expected to pay a portion of those prices in the form of cost-sharing. Those with chronic conditions need to stay engaged in seeking value, regardless of the location where they receive care, otherwise they may forgo medically necessary care.

Some may argue that real price transparency may reveal that certain “vulnerable” institutions are not price competitive. While that may be true for some services, extensive experience at the state level shows that many community, safety-net or rural facilities are excellent values and price competitive. In fact, real price transparency is an opportunity for these facilities to attract additional higher reimbursing privately insured patients seeking high-value care whose plans will pay more than the publicly-funded Medicaid and Medicare programs that many of these facilities so heavily rely on now. What’s more, with the movement among employers toward incentivizing enrollees to select higher-value providers, such as with lower cost-sharing or even incentive payments, reasonably-priced rural hospitals that could benefit from price transparency, attracting new business from employers who discover their competitiveness and steer patients toward them with financial incentives.

+ MYTH 16: Price is not the most important, quality is.

FACT: Value is the most important. Value is the unique combination of price and quality that meets a consumer’s needs. To allow for consumers in a market to assess value, they must have both. And by the way, we don’t have quality transparency either, so this isn’t an either-or, we need both!

+ MYTH 17: Some hospitals have such high quality that justify their higher prices.

FACT: Is our quality science good enough to know if that’s true? Without price and quality transparency, these are just unsubstantiated assertions. The only way to verify if prices are justified by quality is to be transparent about both and compete on that basis.